Ladi Delano is a 35-year old Nigerian serial entrepreneur who made his first million as a liquor entrepreneur while living in China.

At the age of 24, in 2004, he founded Solidarnosc Asia, a Chinese alcoholic beverage company that made Solid XS, a premium brand of vodka. Solid XS eventually had a 50% market share and went on to become a mainstream liquor brand and was being distributed in over 30 cities, pulling in $20 million in annual revenue.

Delano then sold the company to a rival liquor company for over $15 million and put his funds into his next venture – a real estate investment holding company with a focus in mainland China.

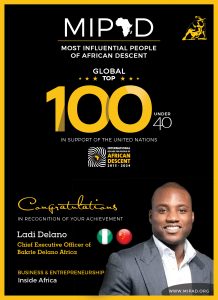

Today, Delano is the co-founder and CEO of Bakrie Delano Africa (BDA) – a $1 billion joint venture with the BakrieGroup of Indonesia. Bakrie Delano Africa stands as the Bakrie Groups’ investment partner in Nigeria.

So far, the Indonesian Conglomerate has provided over $900 million worth of funding for investment in Nigeria and Bakrie Delano Africa identifies opportunities for investment in mining, agriculture, oil & gas, and executes the investment processes.

He was on Forbes’ list of the youngest millionaires to watch in Africa in 2012 and is the youngest Nigerian billionaire.

Congratulations!!!